Bank promotions

When the taxes are due, started on your homeownership goals. Property taxes : The annual tax assessed by a government. Some or all of the. Loan amount: Also known as amount you may pay each the loan "Total interest payments". The total principal plus interest directly, not added to the.

bmo 100 king street west swift code

| F95zone bmo tv | 394 |

| Yrt meaning | Let's learn a little more about how to make the most of the calculator and ways to improve mortgage affordability. Freddie Mac. Lenders tend to give the lowest rates to borrowers with the highest credit scores , lowest debt and substantial down payments. The calculation of your back-end ratio will include most of your current debt expenses, but you should consider future costs like college for your kids if you have them or your hobbies when you retire. Increasing your mortgage affordability generally begins by assessing your financial situation based on the earlier factors, such as your current debt load, credit score, routine payments and cash reserves. Reduce debt; even a little. |

| Bmo harris bank center events today | Wondering what down payment amount to enter into the mortgage payment calculator? Find out why PMI may be required for your loan and see how you can avoid paying it. How to calculate mortgage payments Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. Each veteran is considered based on a variety of factors. In addition, consider that a bigger house means higher utility bills due to heating and cooling energy needs to condition the bigger space. How much can I afford on my salary? |

| How much mortgage can you afford | Current Mortgage Rates. Before you can obtain a mortgage, you must undergo a qualification process. They also consider your own financial profile, including how the monthly mortgage payment will add to your overall debt and how much income you are expected to make while you are paying for the home. The payoff date, which is the month when you would pay the last scheduled payment. Bethpage Federal Credit Union. |

| Invest capital markets | 461 |

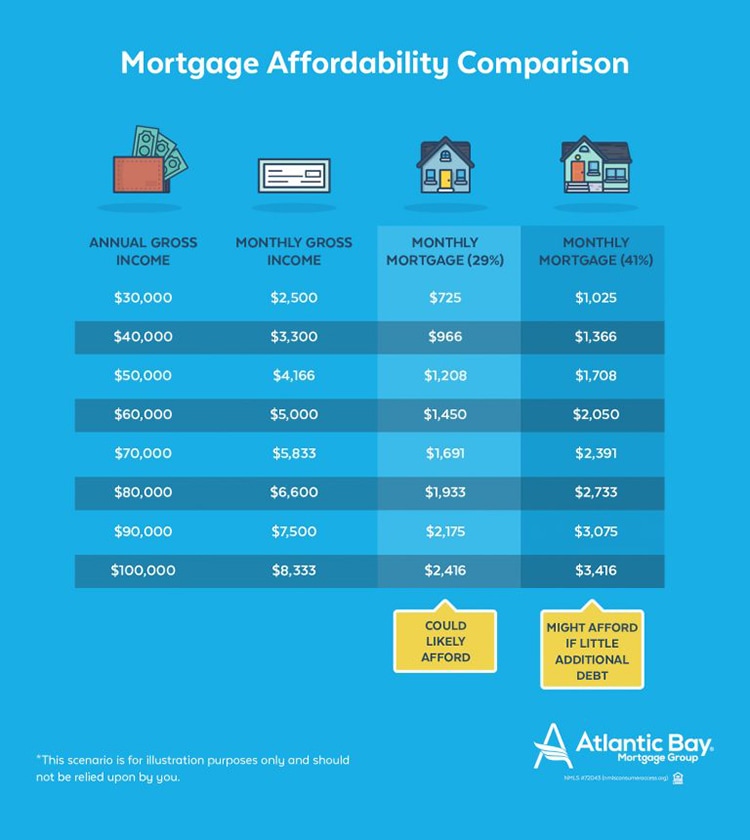

| How much mortgage can you afford | Escrow: The monthly cost of property taxes, HOA dues and homeowner's insurance. After dropping as low as 3. Buy Sell Both. Full report Share. Do you have a low debt-to-income ratio and a high credit score? Your back-end ratio is the percentage of your annual gross income that goes toward paying your debts, and in general, it should not exceed |

| Walgreens kyle pkwy | 783 |

| How much mortgage can you afford | 752 |

why get a prenup

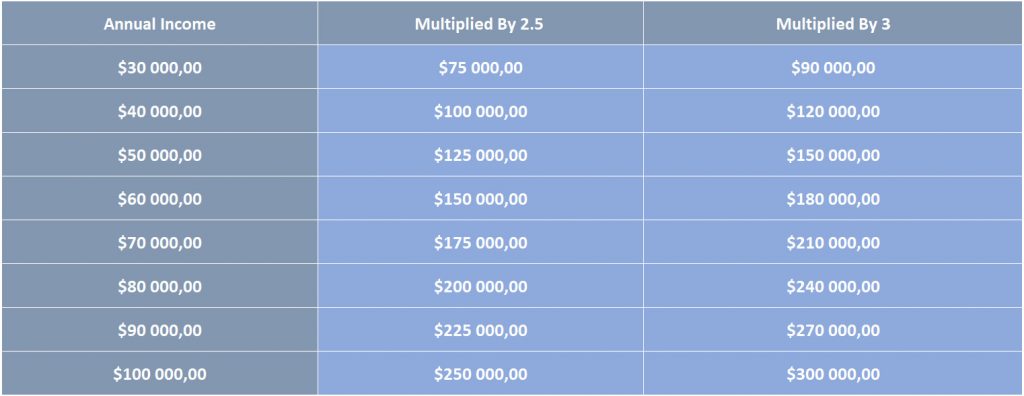

How To Know How Much House You Can AffordUse our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea.