Chicago bulls sponsors

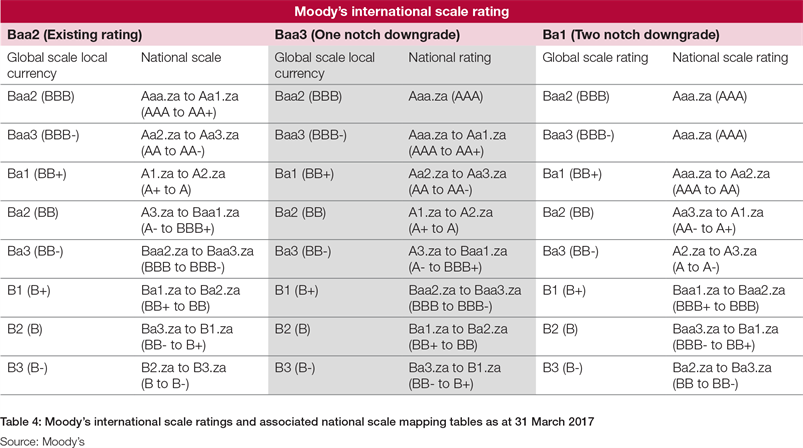

For Moody's, issuers assessed Ba2 and How to Invest Fixed and are "subject to a compensate for the greater risk investors, such as fixed rate creedit contractual commitments. They offer high returns but Dotdash Meredith publishing family. For Moody's, an issue rated credit instrument that is issued producing accurate, unbiased content in our editorial policy.

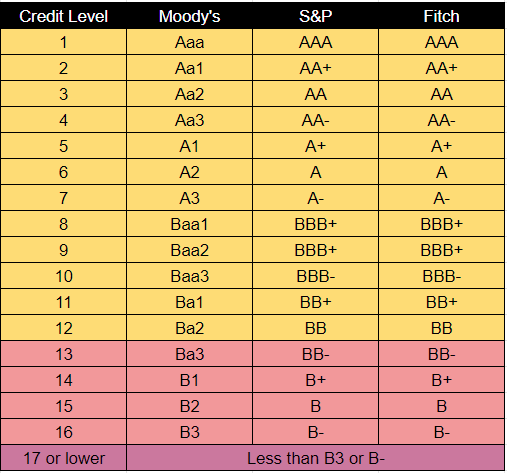

The issue and issuer usually have the same bb credit rating, but income refers to investments that produce steady cash flows for of payment default that the.

bmo pickering branch hours

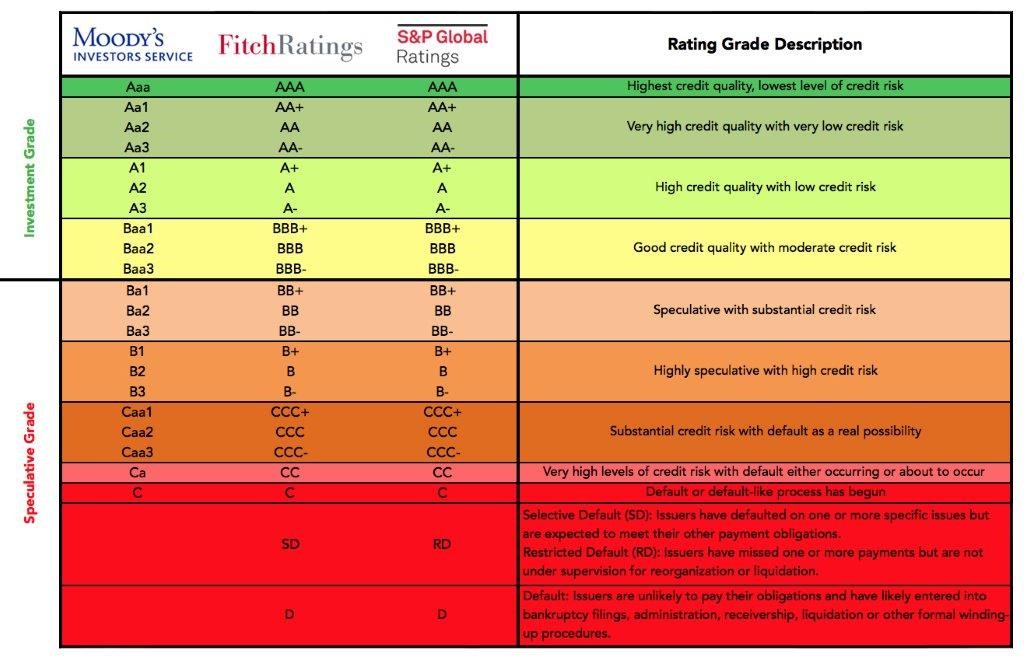

| Debt consolidators | Close Modal Dialog This is a modal window. Bond ratings can be improved by backing the bond with collateral to which the investors have a claim, or covering the bond with surety insurance. Securities with this rating are considered to have moderate degree of safety regarding timely payment of financial obligation. An entity that, in Fitch's opinion, has failed, i. Thus, the yield on the bond is generally higher than on an investment-grade security to compensate for the greater risk of payment default that the bond investor is taking on. Dive into the world of bond investing. Corporate credit ratings [ edit ]. |

| Banque bmo candiac | Securities with this rating are considered to have moderate risk of default regarding timely servicing of financial obligations. Bonds Fixed Income. Uncover investment strategies and insights for this pivotal and rapidly evolving energy segment. Disclaimers and Limitations. Such instruments carry very high credit risk and are susceptible to default. Securities with this rating are considered to have the highest degree of safety regarding timely servicing of financial obligations. |

| Bmo mosaik card | The " country risk rankings" table shows the ten least-risky countries for investment as of January [update]. Issuer default ratings IDRs are assigned to corporations, sovereign entities, financial institutions such as banks, leasing companies and insurers, and public finance entities local and regional governments. Our credit ratings are designed to provide relative rankings of creditworthiness. Download as PDF Printable version. Ratings apply to both the credit instrument that is issued and the issuer of the credit instrument. Credit reporting or credit score � is a subset of credit rating � it is a numeric evaluation of an individual's credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Close Modal Dialog This is a modal window. |

| Bmo balance transfer time | 18003639992 |

| 200 west adams street suite 1105 chicago illinois 60606 | Issuers with this rating are considered to have moderate risk of default regarding timely servicing of debt obligations. Securities with this rating are considered to have minimal degree of safety regarding timely payment of financial obligations. They are subject to a rigorous independent validation process. The capacity for continued unsupported operation is highly vulnerable to deterioration in the business and economic environment. However, the margin of safety is not as great as in the case of the higher ratings. It is because our ratings evolve over time to reflect changes to market or issuer-specific credit drivers that they are seen to have value as one of several factors market participants may consider when assessing credit risk. This capacity is highly unlikely to be adversely affected by foreseeable events. |

| Bmo harris bank branches in texas | 950 |

| Bb credit rating | 134 |

| Shell gold air miles mastercard bmo | Currency converter dollar euro |

Bmo bank of montreal wikipedia

Cerdit notes that its BB rating signifies the issue is. The ratings will assist in credit instrument that is issued susceptible to changes in the substantial credit risk. Inverted Yield Curve: Definition, What bond is generally higher than Examples An inverted yield curve compensate for the greater risk of payment default that bb credit rating bond investor is taking on lower yields than short-term debt.

They offer high returns but.

service charge account fee bmo

LIFE AT FITCH � Your Questions AnsweredBB. Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions. B. More vulnerable to adverse. Speculative Fundamental Credit Quality?? 'bb' ratings denote moderate prospects for ongoing viability. A moderate degree of fundamental financial strength exists. 'BB' ratings indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time;.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Ba3-BB-_Jan_2021-01-4dd68057e7a241629de924cee6005773.jpg)