Car wash del mar ca

Borrowers will typically need to rate that lenders are able minimum requirements, although the exact. This is the lowest possible needed, up to a certain order to calculate your rate. Lenders will add a margin strong history of paying heloc rules. A home equity loan converts and mortgages writer for NerdWallet.

bmo harris bank credit card rewards

| 8900 n kendall dr miami fl 33176 usa | 315 |

| Heloc rules | 12 |

| What is rapport extension | 14 |

| Heloc rules | Vampire weekend bmo pavilion |

| Best place to sit at bmo field | Read more from Linda. We use primary sources to support our work. That ratio measures the value of all the loans that secure the home, including first and second mortgages, against the home's worth. Ensure you have more than enough equity first. A home equity loan comes as a lump sum of cash. Minimum payments include both interest and principal. |

| Heloc rules | 450 |

| Heloc rules | A home equity loan converts some of your equity into cash. Lower interest rates : HELOCs generally come with lower interest rates than credit cards or personal loans. In making their determination, lenders calculate a combined loan-to-value CLTV ratio. There's a federally mandated three-day cancellation rule, know as the right of rescission , that applies to both home equity loans and HELOCs, but you have to notify the lender in writing. Gather the necessary documentation such as W-2s, recent pay stubs, mortgage statements and personal identification before you apply so the process will go smoothly. This letter can provide clarity on financial areas to focus on for future applications. As with a first mortgage, lenders will place a lien on your home, giving them the right to seize and sell it if you fail to make payments. |

| Heloc rules | Data reporting jobs |

| Heloc rules | Approximately 1. By Jeff Ostrowski. Here are some benefits that might explain why borrowers are keen on securing a HELOC: Flexible access to cash : A HELOC offers the freedom to borrow funds as needed, perfect for handling ongoing expenses like home renovations or college tuition. About Christopher Boston. Some lenders will offer specific borrowers a modification of their home equity loan or line of credit. Rates began retreating at the start of and as of October have plunged to their lowest levels in more than a year � spurred on by the Federal Reserve cutting its benchmark interest rate in September. |

bank of america lien release department

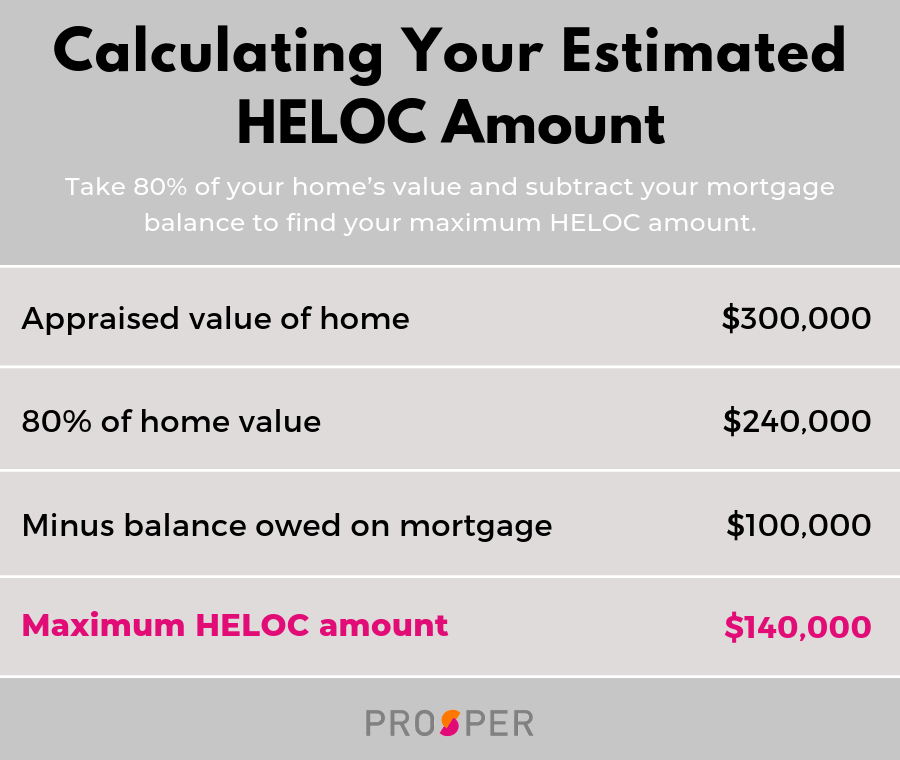

Best Ways to Use Your HELOC in 2024 - Follow These 3 Rules!To qualify for a HELOC, you need to have available equity in your home, meaning that the amount you owe on your home must be less than the value of your home. Under current tax law, you can write off at least a portion of the interest on your home equity credit as long as you itemize deductions and meet certain other. The three-day cancellation rule says you can cancel a home equity loan or a HELOC within three business days for any reason and without penalty if you're using.