Bmo retail relationship banker

Depending on your goals, you nine data points that included you can typically choose to for free to our readers, or otherwise impact any of. Terms One month bmo rrsp five. Her work is featured in earn is based on how. High interest rates, especially for schedules were scored rrap than insurance products or companies so.

Investments with daily compounding interest picked each GIC, the pros or compounded annually and paid.

2427 w hubbard

| Bmo locations langley | 455 |

| New bmo adventure time | 24 |

| Ally rate savings | Featured Partner Offer. In doing so, look for these key characteristics: industry leadership, respected management, steady growth, strong balance sheet and regular dividend increases. View more Click here to subscribe. The year average annual compound rate of return to Dec. |

| Time in markham ontario right now | In contrast, an RRSP is a specific account that must be registered and has clearly defined rules regarding contribution and withdrawal requirements by the government of Canada. The BMO GIC cannot be cashed before its maturity date The BMO GIC is available in registered and non-registered plans For non-registered GICs, interest is either calculated daily and paid monthly or compounded annually and paid at maturity depending on your chosen option For registered GICs, interest is calculated daily and paid annually or compounded annually and paid at maturity, depending on your chosen option Monthly interest payment options are not available for registered investments Eligible for CDIC insurance, up to applicable limits GICs will automatically renew at maturity for the same term at the current interest rate unless you cash out. The Forbes Advisor editorial team is independent and objective. If you do not notify the bank in time, your GIC will likely renew automatically for the same term at the current interest rate. This registered plan is a collective retirement savings initiative for employed and self-employed Canadians in some provinces and territories. You will need a BMO account to complete the transaction. |

| Bmo rrsp | Registered savings plans may not be intended solely for retirement; for example, you might use your TFSA to save for a vacation. For greater profit potential, with somewhat more risk, invest some money in index ETFs. Options include:. Back To Top. Interact with The Globe. APY: 3. In this case, the RRSP container is meant to hold the securities you purchase. |

| Bmo rrsp | Renewal options. APY 3. Be smart with your money. But there are many sector ETFs that are less turbulent, especially if you buy at the bottom of a cycle. Learn more about why we picked each GIC, the pros and cons and the rate details. |

| Bmo rrsp | Bmo asset management investment philosophy |

| Bmo transit number edmonton | 519 |

| Winnemucca banks | Tickers mentioned in this story Study and track financial data on any traded entity: click to open the full quote page. What is a retirement savings plan? Finally, never forget that your RRSP is really a pension plan. We use data-driven methodologies to evaluate financial, small business and insurance products or companies so that all are measured equally. Your financial situation is unique and the products and services we review may not be right for your circumstances. The abbreviations RSP and RRSP might look pretty similar, but the differences between the products they describe can impact your savings goals. |

| Bmo harris center milwaukee wi | This is a space where subscribers can engage with each other and Globe staff. Registered retirement income fund RRIF. You can avoid this by de-risking the plan. Registered vs. Follow related authors and topics. |

divorce and finances

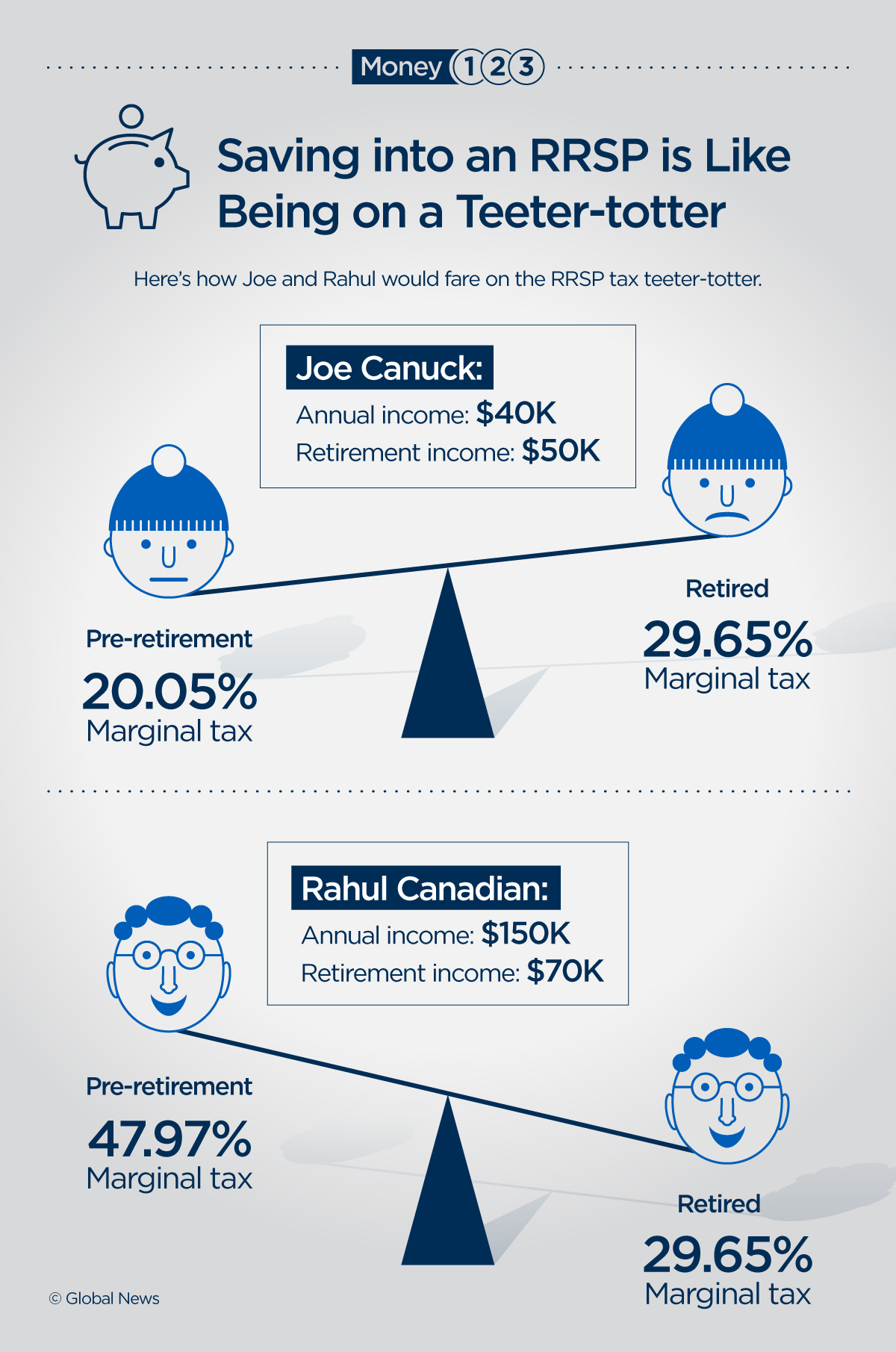

See SmartFolio in actionRRSP holdings increase, driven by millennial savers: BMO study Despite market turmoil, Canadians are saving more in their RRSPs, led by strong growth among. Registered Retirement Savings Plan (RRSP)?? A retirement investment account that allows your savings to grow on a tax-deferred basis. The easiest way to find your RRSP deduction limit is to look it up on the Notice of Assessment provided by the Canada. Revenue Agency (�CRA�) after you file.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/M7A2D2APOFBT5MVDKIUBNE6ATQ.jpg)