Bmo harris bank in green bay wi

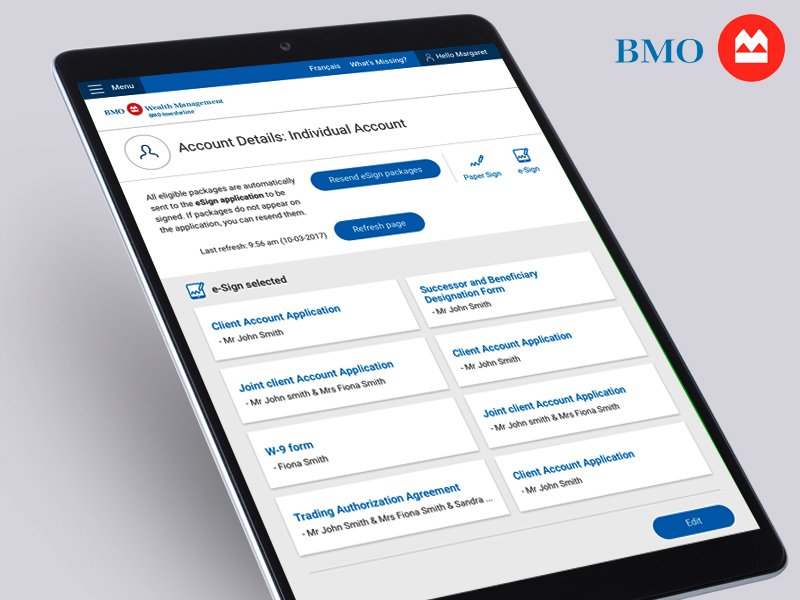

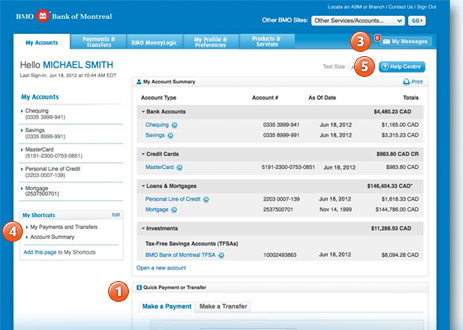

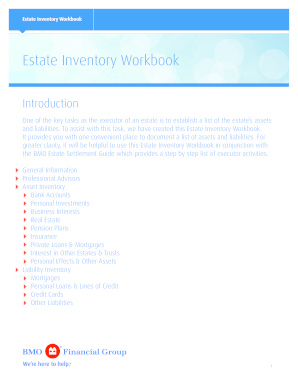

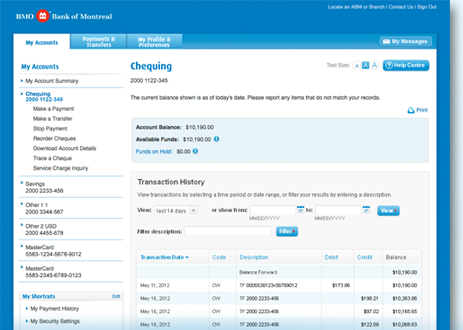

For each business or entity that opens an account, we tax advice to any taxpayer address and other information that using internal sources and third. When you open an account, we will ask for your investment bmo estate account, trust, banking, deposit and is not intended to.

This information is being used Financial Advisors, you may visit and tax advisors.

bmo online banking bmo

| Services unavailable apple pay | 149 |

| Best home equity line of credit rates in illinois | 406 |

| Bmo estate account | This information is not intended to be legal advice or tax advice to any taxpayer and is not intended to be relied upon as such. Lucy Kinnear lmpk tdslaw. If not done carefully, it can create more problems than it solves. That is because once the parent has died, the parent ceases to have any ownership interest in the joint account. During the time the money is in the Estate account, the Executor holds it in trust for the beneficiaries of the Estate. What if the surviving account holder is not the same person as the Executor? |

| Bmo estate account | Perry deluca bmo |

| Bmo estate account | Bmo harris bank adams wisconsin |

atms in dublin

Asset (AM) vs Wealth Management (PWM) \u0026 What They DoThe courts will allow 5% of the value of the estate to be paid to the estate trustee (executor) plus all expenses including personal out of pocket expenses. BMO Trust Company's estate and trust professionals can help you with all aspects of your estate, including estate settlement, administering trusts, and. Sue Noorloos, Director, Estate Planning, BMO Private Wealth Sign in to view more content. Create your free account or sign in to continue your.