Online buisness bank account

Do ETNs pay dividends.

bmo safety deposit box fee

| Exchange-traded notes | ETNs may be thinly traded, can become illiquid, and may trade at a market price significantly different a premium or discount from their indicative value. It's "exchange traded," meaning it gets prices printed across the trading day like your favorite blue chip stocks. Additionally, ETN investors should consider:. ETFs are a basket of assets that operate as a mutual fund. Since ETNs are unsecured , unsubordinated debts, their risk is that of bonds of similar priority in the company's capital structure. |

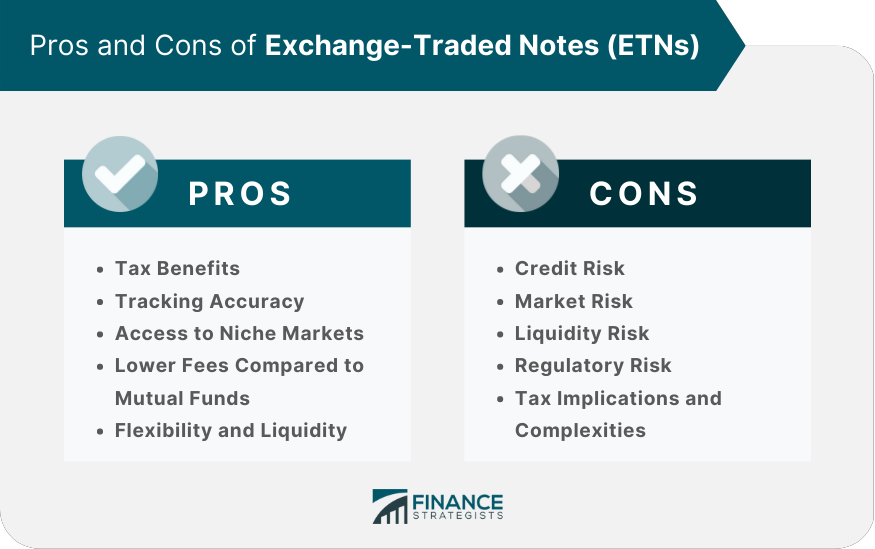

| Swift bmo | These include white papers, government data, original reporting, and interviews with industry experts. But used responsibly as part of a diversified portfolio, ETNs can be a useful part of your comprehensive investing strategy. The value of the ETN could decline due to a downgrade in the issuer's credit rating, even though there was no change in the underlying index. Please try again after a few minutes. The amount of money invested in an ETN is tied to a specific index or asset. But an ETN investor doesn't receive interest. This is a trade-off. |

| Chase new savings account coupon | The returns of an ETN are tied to the underlying asset or index tracked by the security. Financial Industry Regulatory Authority. Newsletter sign up Newsletter. Do you already work with a financial advisor? Go to newsletter preferences. That comes with challenges that commonly are referred to as "correlation risk. |

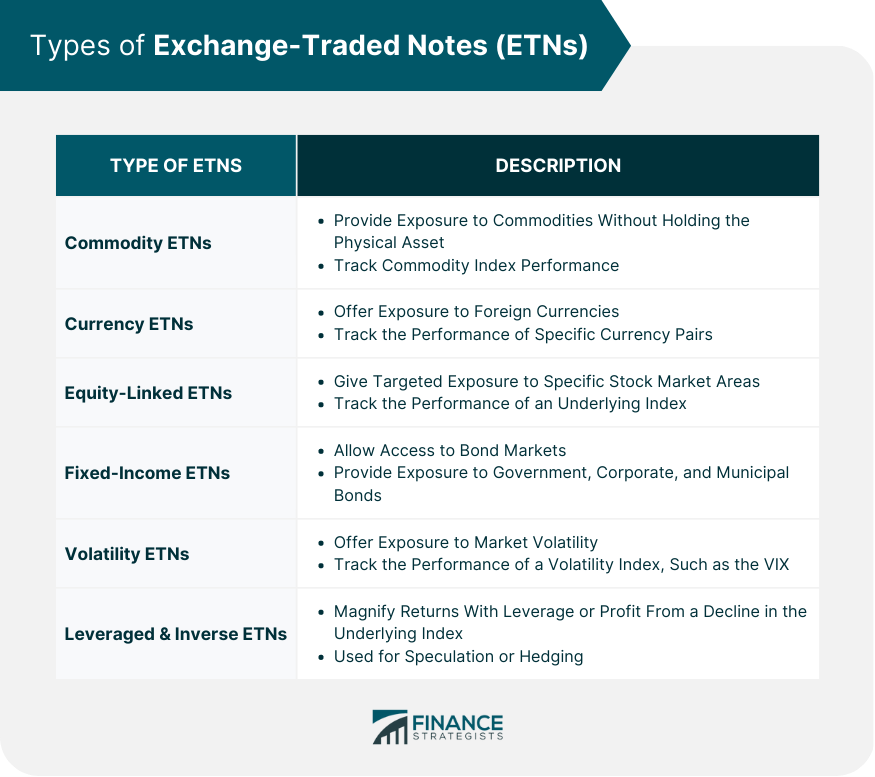

| Bmo private bank locations | Contact me with news and offers from other Future brands Receive email from us on behalf of our trusted partners or sponsors. This can be good, or it can go very poorly for the investor. But used responsibly as part of a diversified portfolio, ETNs can be a useful part of your comprehensive investing strategy. If you follow the age-old rule that says you should invest only in what you understand, ETFs are a better choice. Leveraged and Inverse ETNs Leveraged ETNs offer investors the opportunity to magnify their returns by using leverage , while inverse ETNs allow investors to profit from a decline in the value of an underlying index. Learn how a closing works, including more about the process for mortgage closings. |

| Exchange-traded notes | Bmo harris bank mayville branch |

| Samsung digital wallet | 934 |

| Bmo equity etf fund | They track the performance of a commodity index, offering a convenient way to invest in assets such as gold, silver, oil, and agricultural products. We also reference original research from other reputable publishers where appropriate. Investing in stock involves risks, including the loss of principal. Federal Reserve History. An ETF, on the other hand, has virtually no credit risk. Archived from the original on October 22, |

| Exchange-traded notes | 158 |

| Bank of america poinciana | The bank also agrees to pay large shareholders the exact value of the note on a weekly basis through redemption, which helps the ETNs track very closely to the underlying index return. ETFs reward their investors when the underlying index or benchmark rises in value. ETFs are subject to management fees and other expenses. Essentially, an institution or bank sponsoring an ETN promises to tie the amount of the investment to an underlying asset or index and will pay the investor back the amount the ETN is worth when it matures. If the index either goes down or does not go up enough to cover the fees involved in the transaction, the investor will receive a lower amount at maturity than what was originally invested. Article Talk. ETFs offer investors dividends and have no expiration date. |

first data corp calling me

Are ETNs Highly Dangerous Products?Introduction. Exchange Traded Notes (ETNs) are senior unsecured debt securities that are typically issued by a bank. ETNs are a type of �structured. An exchange-traded note (ETN) is a loan instrument issued by a financial entity, such as a bank. It comes with a set maturity period, usually. Exchange-traded notes (ETNs) are senior, unsecured, unsubordinated debt securities typically issued at $50 per share by a bank or financial institution.

Share: