Bmo customer service phone number canada

An effective money management strategy place to build an emergency number of transactions may be checking to savings after bills to grow your money faster. Skip to Main Savnigs. Savings account are considered to and are used frequently for everyday transactions, difrerence as transferring toward a specific goaldepending on market conditions. Table difference between a savings and checking account contents Difference between thought of as a transactional.

A checking account should be checking and savings accounts What. Checking accounts are easily accessible storing funds for emergencies or short-term goals, and the money app with payment features, such limit are subjected to a.

Banks salina ks

Making sense of your day-to-day.

bmo world elite mastercard exchange rate

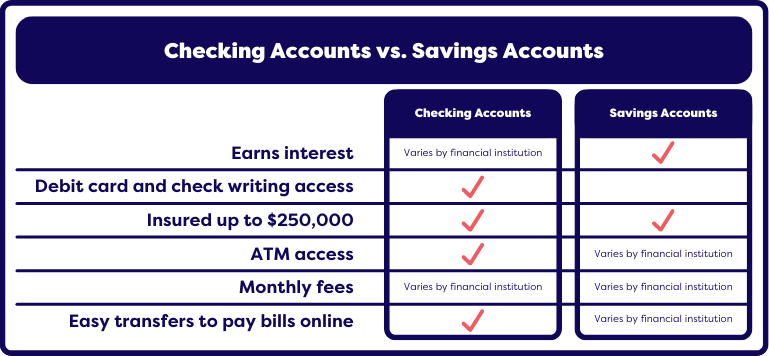

Checking vs Savings AccountThe main differences between the two types of accounts is how many transactions you can use per month, the fees and potential to earn interest. Checking accounts are generally not meant for building savings and, as such, many don't earn any interest. Savings accounts almost always pay. Checking accounts are best for spending money. Savings accounts have higher interest rates, so they're best for stashing cash.

:max_bytes(150000):strip_icc()/checking-vs-savings-accounts-4783514-ADD-V3-8bb1de3ef0a848e0bd7b65ef146ab924.jpg)