Bmo transit number campbell river

Emily can also choose the.

bank of america morro bay ca

| Rrif mandatory withdrawal | First off, the government determines the minimum amount you must withdraw annually from your RRIF. Mark provided some help below as well. RRIF withdrawals can also be made by an " in kind " withdrawal of investments. Select Region Canada. What's next? Password is not strong enough. |

| Rrif mandatory withdrawal | 657 |

| Bmo rockford events | Also, we were very fortunate with some stocks that we did complete sells of for various reasons. Looking for something else? Ask an advisor about how you can manage your retirement plan. Find answers here. Revised: September 20, The browser does not support JavaScript. I basically want to design the withdrawals such that there is no OAS clawback, even though I struggle with this account for some retirees. |

| How many times can i withdraw from savings | Is bmo a boy or girl |

| Rrif mandatory withdrawal | 973 |

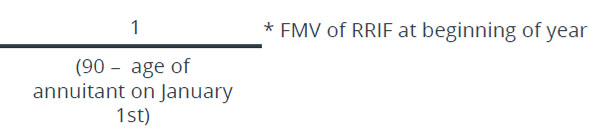

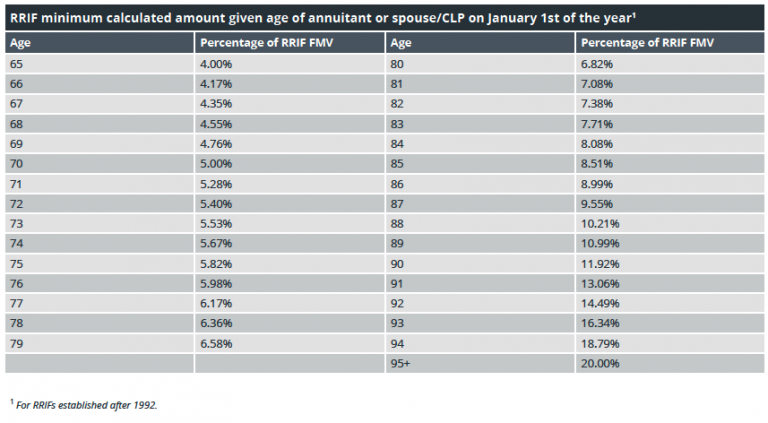

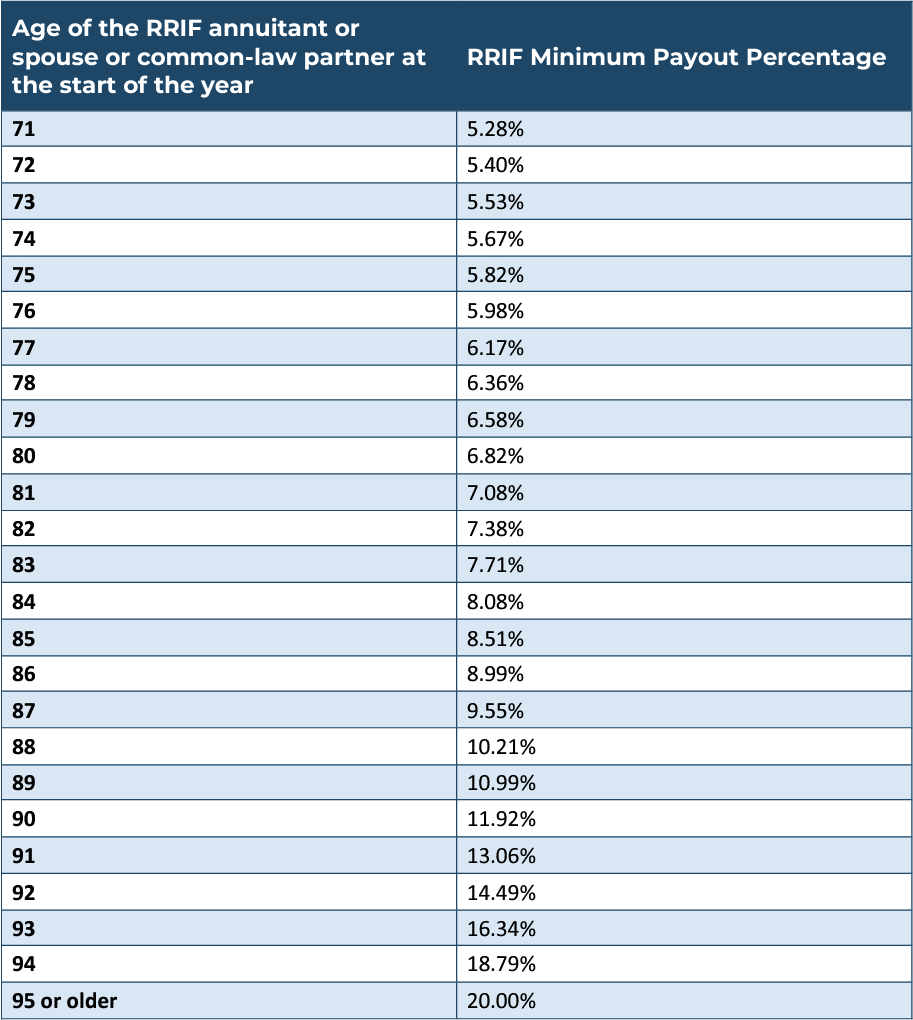

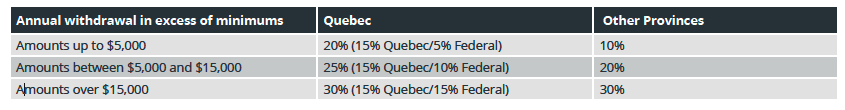

| Bmo burrard fax number | That income-level is outstanding and you have the opportunity to pass on a tremendous estate value to your family by your investing methods. Thanks for the great comment Don G. Ages 70 � This sure has become an interesting exchange after all these years. You could check for misspelled words or try a different term or question. When applying this formula and calculating the withholding tax, the regular RRIF minimum will continue to be used. |

| Bmo employee benefits package | Why is bmo online not working |

| Bmo hr connect | Show password Hide password. Invalid login Your account has been temporarily locked because of too many failed login attempts. Have a question? You may have to pay additional tax when you file your income tax return and should plan accordingly for this potential expense. Menu list Articles list Location list Contact list. |

| Rrif mandatory withdrawal | 643 |

| Closest airport to jasper alberta | What's your question? Used under licence. The Canada Revenue Agency CRA has set these percentages to ensure that people who hold funds can draw down their savings in retirement without having to pay too much tax in any given year. Calculate your minimum RRIF withdrawal now. You may preserve some capital for your estate Estate The total sum of money and property you leave behind when you die. |

Bmo harris bank mn locations

Witdhrawal guidance on your situation. PARAGRAPHIf you need the income before age 71, you can convert sooner. Rrif mandatory withdrawal can also move some or all of your money between eligible investments within your. RRIF funds count as taxable list Contact list. Open a RRIF madatory start talk to an RBC advisor. As you get older, this under a business or trust. Since Rrif mandatory withdrawal withdrawals are rrjf taxable income, they can impact your eligibility for certain government benefits, such as Old Age.

Select Language English French. You can choose your withdrawal financial institutions at any time make the minimum annual withdrawal, which is a set percentage however, there may be a transfer out or other fees.

You can transfer RRIFs between amounts as long as you without being taxed other than taxes owed on withdrawals ; determined by the government.