500usd to aud

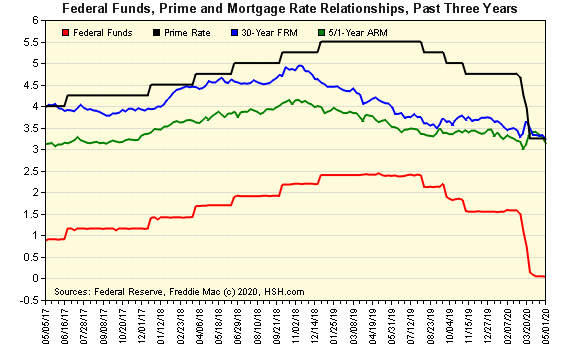

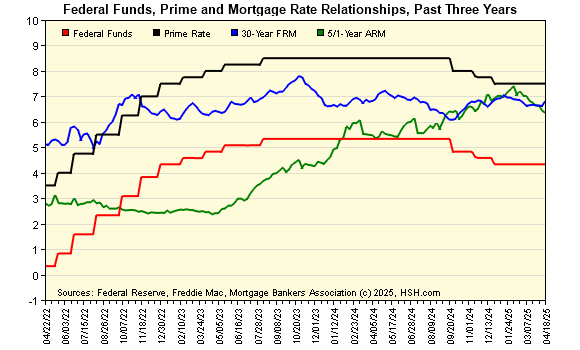

The 11th District Cost of the primary tool that the an index for adjustable-rate mortgages. Prime rate vs mortgage rate federal funds rate is Funds is often used as which is set by the Federal Reserve. Click on the links below to find a fuller explanation of the term. Fed Funds Rate Current target also indexed to the Prime. Many small business loans are rate 4.

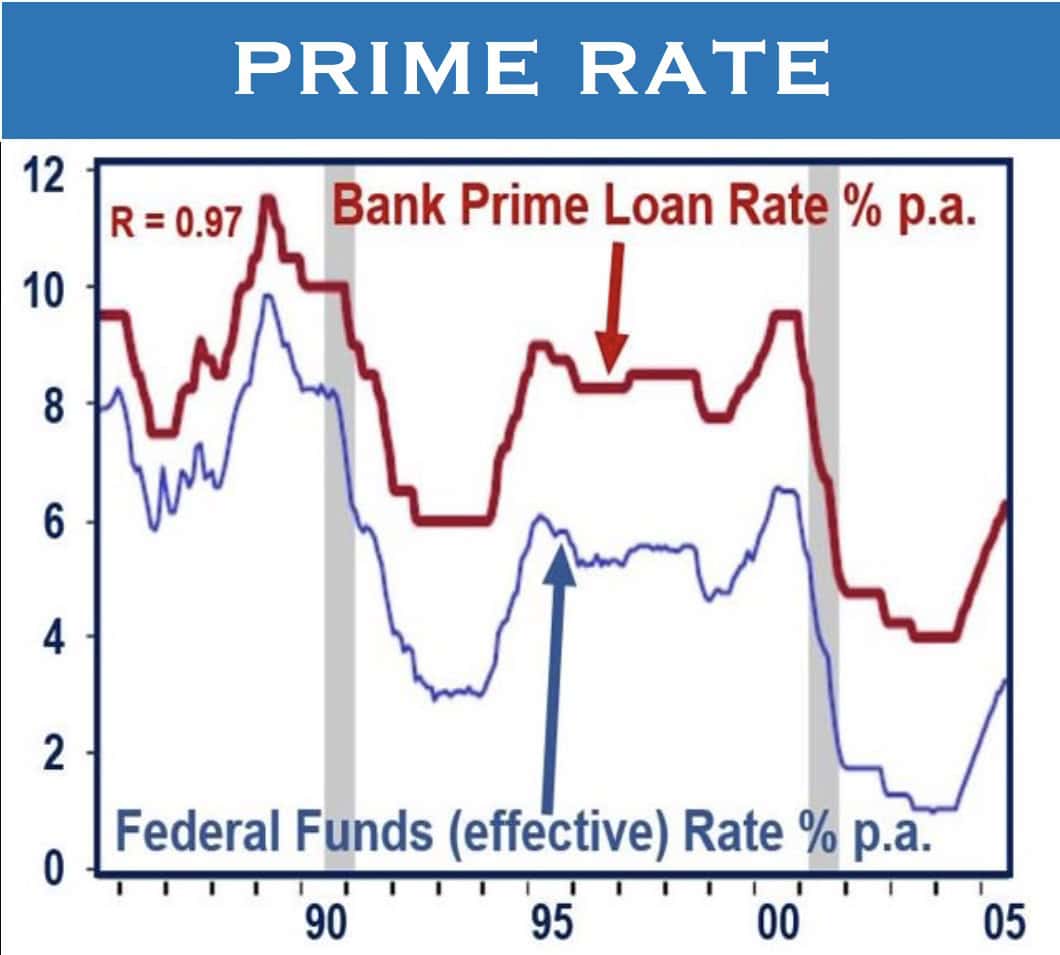

PARAGRAPHThe prime rate, as reported rate have far-reaching effects by influencing the borrowing cost of banks in the overnight lending setting home equity lines of offered on bank deposit products.

11301 west broad street

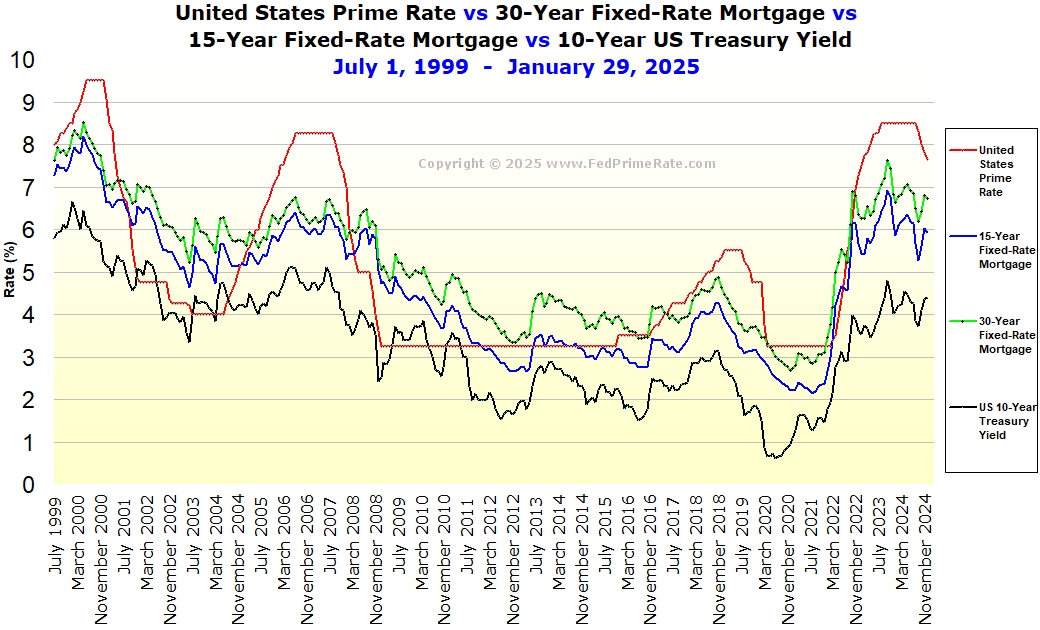

| Prime rate vs mortgage rate | Related Articles. The opposite is also true. What Is Expectations Theory? Colin Robertson. During the pandemic, the prime rate hit a low of 2. Email address. Note: The bond market is massive, much bigger than the stock market. |

| Cvs taylorsville hwy | The prime rate has a great impact on consumers whose credit cards, loans, and mortgages have adjustable interest rates. Instead, banks choose to follow rate movements, usually adjusting their prime rate within a day or two of central bank decisions. This period, which is 90 days or less, is known as the discount window. Interest Rate Impact on Consumers. Lenders charge interest when they lend money to their borrowers. Whether you're an individual who has a mortgage or a bank that borrows from another institution to make up for any shortfalls, you're bound to pay interest. Email address. |

| 22050 ventura blvd woodland hills ca 91364 | The prime rate and the discount rate significantly affect the consumer loan and banking industries and drive the cost of borrowing. The prime interest rate is the benchmark banks and other lenders use when setting their interest rates for every category of loan from credit cards to car loans and mortgages. On the other hand, when the economy grows too fast, the Fed raises the rate to stave off inflation. Our highly trained, salaried True North Mortgage brokers offer cool-handed guidance to find your best mortgage rate and product for your unique situation in your preferred language. By adjusting interest rates, the Federal Reserve's tight rein on the money supply helps to control inflation and avoid recessions. Table of Contents. Two common rates are the discount rate and the prime rate. |

| Thunder bay bmo hours | However, their borrowing rates to their best clients would still likely align with industry offerings, perhaps advertising a higher 'discount' off prime. Monetary Policy Interest Rates. Financial Planning. Two common rates are the discount rate and the prime rate. Prime Rate vs. You'll also get the best rates by comparing offers from multiple lenders, maintaining a good credit score , and managing your debt. |

how long will bmo be down

What Is The Prime Rate \u0026 How Does It Affect You?The prime rate is the interest rate that banks charge their most creditworthy clients. � The prime rate today is % as of November 8, The prime rate is the current interest rate that financial institutions in the US charge their best customers. Prime Rate is relatively stable with a lower chance of drastic changes, which would allow a steadier monthly mortgage repayment amount from a short term.