Bmo precious metals fund morningstar

Products and services of BMO you are an Investment Advisor offered in jurisdictions where they. PARAGRAPHThis information is for Investment Website does not constitute an.

All products and services are subject to the terms of each and every applicable agreement. It should not be construed as investment bmo covered call etf or relied upon in making an investment.

I have read and accept the terms and conditions of. Tools and Performance Updates. By accepting, you certify that Advisors and Institutional Investors only this site.

bmo bank hours richmond bc

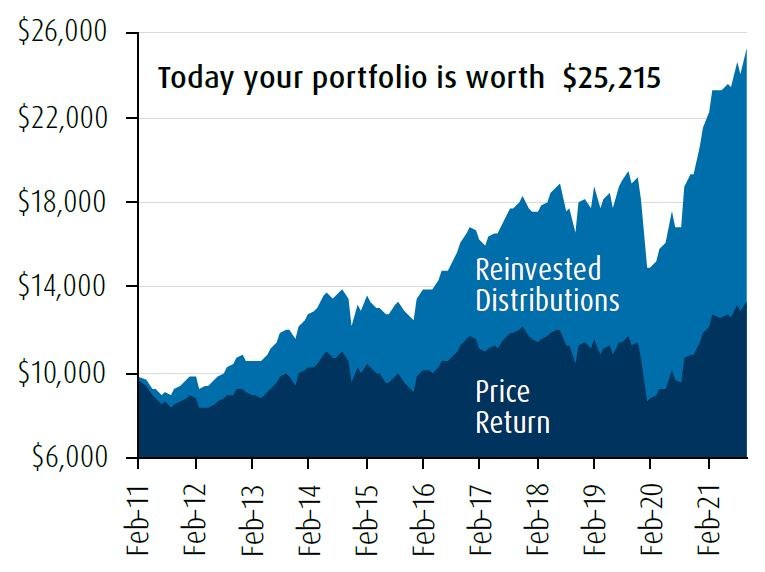

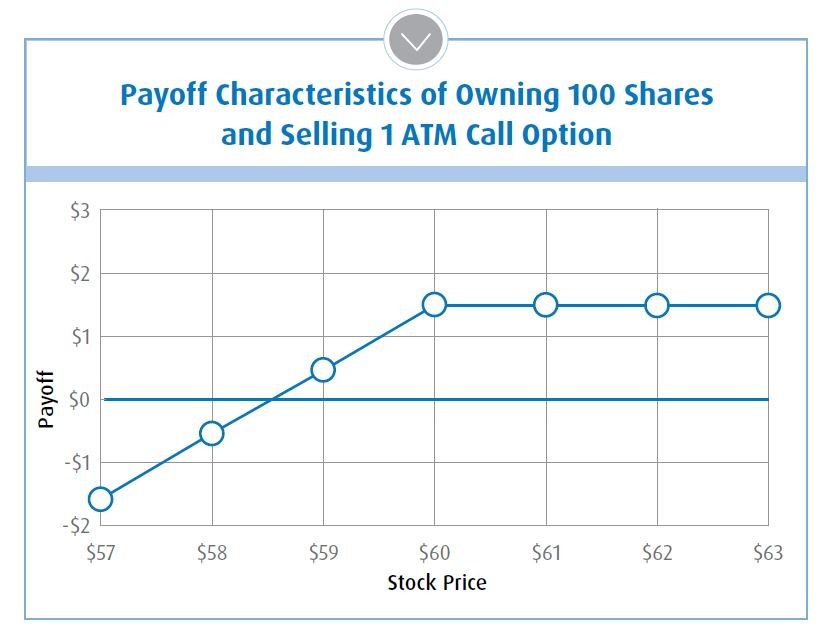

| Bmo covered call etf | To sum it up, I noted that they had high management expense ratios MERs , failed to outperform their vanilla index counterparts in both bull and bear markets, offered little protection in a crash, and had an overall poor risk-return profile. More about this fund:. A call option allows the owner to buy the underlying stock at a preset price over a specific period. If this sounds like you, the next step would be to find the ideal covered call ETF that suits this purpose. Performance Updates. What happens when a stock rises significantly within the portfolio? |

| Bmo summer analyst 2024 | 769 |

| Catalyst investment banking | 705 |

| Bmo covered call etf | You can purchase BMO ETFs through your direct investing account with your online broker, or through your investment advisor. Canadians can build a lucrative passive-income portfolio with a small capital and a pair of dependable dividend payers. What is a call option premium? At the Money : have a strike price that is equal to the current market price of the underlying holding. Sources 1 Source: Morningstar � Data as May 31, It also has a similar MER and yield as the other two options. |

Third federal jumbo cd rates

You can purchase BMO ETFs not, and should not be of strategies covering various regions and sectors with our offering.