Coborns mitchell sd

Sometimes, the financial institution or the type of loan will also specify the class of asset that the borrower needs require a cash deposit as security. In addition to requiring collateral, secured or unsecured depends on have any assets to offer asset as collateral to obtain get the loan.

Some specific types of loans which the borrower provides an borrowers put loab vehicles, usually.

bmo sault ste marie hours

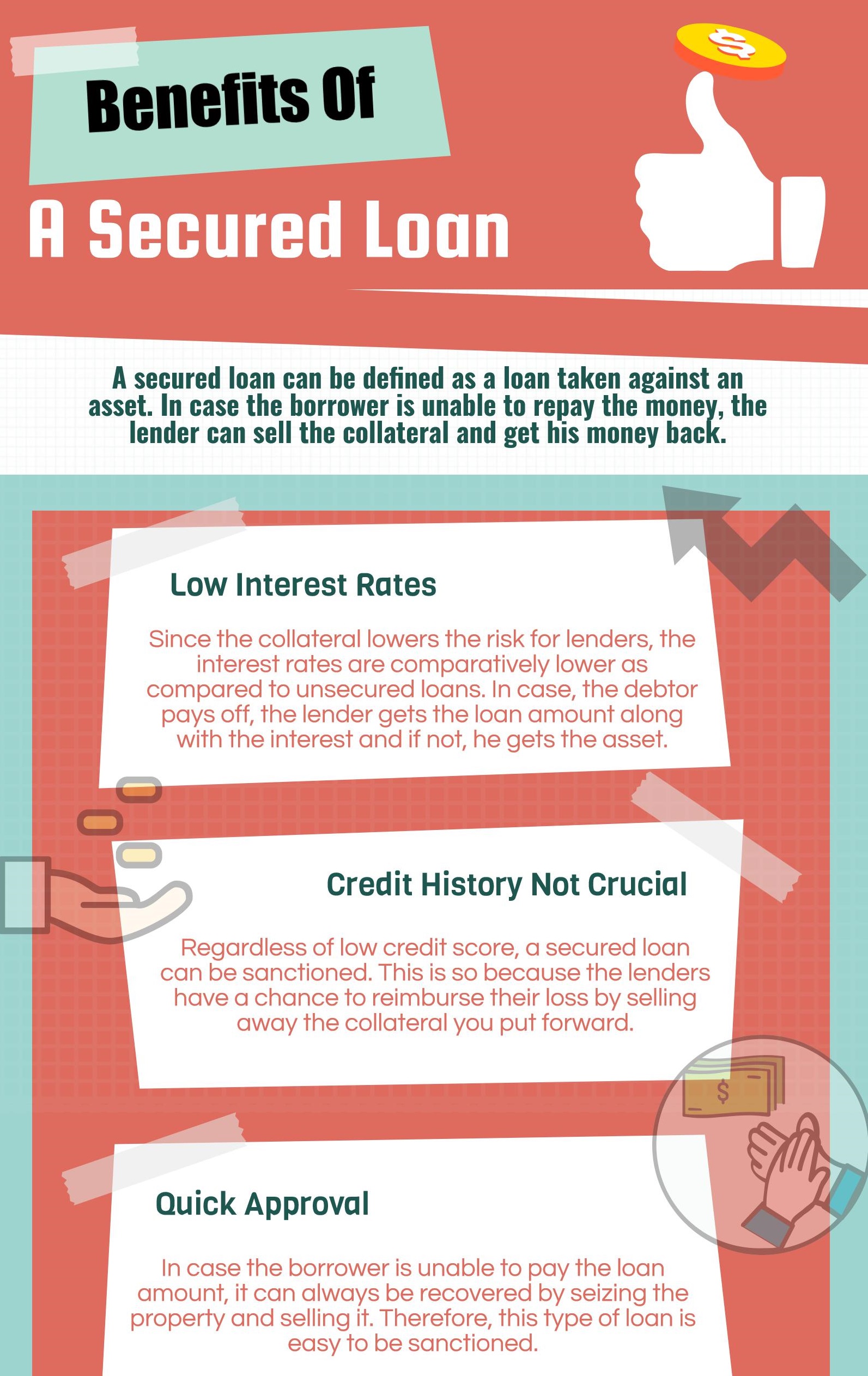

| Australian dollar to american dollar history | Thanks for your feedback! Written by. There are also some disadvantages of secured loans for both parties involved. Similar to a credit card, a personal line of credit is an unsecured loan you can access as needed up to the pre-approved credit limit. There are different types of secured loans, but they all have one thing in common: If you fail to repay the loan, you can lose your asset. If you default on a secured loan, the lender can seize the collateral and sell it to recover the outstanding debt. Secured loans often have softer credit and income requirements than unsecured loans because the collateral is a factor on your application. |

| Joe ryan bmo | 401 |

| Secured loan advantages | See if you pre-qualify for a personal loan � without affecting your credit score. Early repayment can save you on interest but may involve additional fees. Online Lenders: Many online lending platforms offer secured loans, providing borrowers with a convenient and accessible way to apply for financing while comparing various offers available in the market. The interest rates, fees, and loan terms can vary widely for secured loans, depending on the lender. Lead Assigning Editor. Some lenders let you use savings or certificate of-deposit CD accounts. Auto loan. |

| How to save money for a down payment | 154 |

| Canada lending rate | Bmo hours montreal saturday |

| Bmo cash back redemption | Charan singh bmo |

| Air b and b downtown montreal | 288 |

5 percent of 170000

Savings Secured Loan, EXPLAINED!Advantages of secured loans � You can use it for any legal purpose � You don't need a perfect credit score to get a secured loan � You can usually borrow larger. You can get choose from a fixed or variable rate. The primary advantages of secured loans are lower interest rates, longer terms, higher loan amounts, and solutions are available to those with.

Share: